Europe's airlines: Who's growing fastest? Look at fleet orders

According to the CAPA Fleet Database, the 2,379 aircraft orders currently outstanding with European airlines represent 30% of the 7,824 aircraft currently in service (as at 30-Apr-2018). However, these orders are concentrated among relatively few airlines. Among the 72 airlines with outstanding orders (out of a total of more than 500), the number of orders is equivalent to 49% of their combined fleet in service.

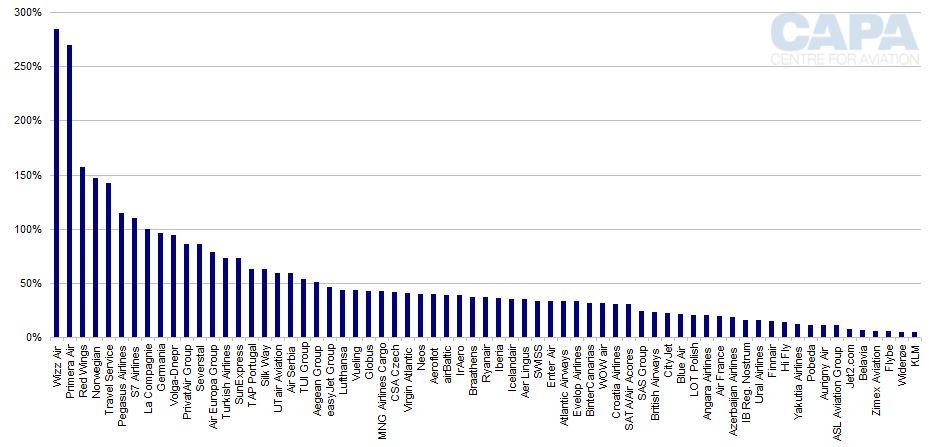

The European airline with the largest number of orders is Wizz Air, with 273 aircraft still to be delivered. Wizz Air also ranks at the top of the list of orders expressed as a percentage of its existing fleet, with a figure of 284%. Ranking European airlines with outstanding orders in this way, rather than by absolute numbers, reveals those with strong ambitions relative to their current size.

Those placed high up the ranking of orders as a percentage of current fleet include some quite large operators, such as Wizz Air, Norwegian, Pegasus Airlines, S7 Airlines and Air Europa, and some smaller ones such as Primera Air, Red Wings, Travel Service, La Compagnie and Germania.

Summary

- There are 72 airlines in Europe with outstanding aircraft orders, while 497 airlines have no orders currently.

- Among the 72, Wizz Air has the highest ratio of orders to number of aircraft in service and KLM has the lowest.

- Wizz Air, Primera Air, Red Wings, Norwegian, Pegasus, S7, La Compagnie, Germania, Volga-Dnepr, PrivatAir, Severstal Airco & Air Europa all have a ratio of orders to current fleet of more than 75%.

There are 72 airlines in Europe with outstanding aircraft orders

Based on data from the CAPA Fleet Database, there are 72 airlines in Europe that currently have outstanding aircraft orders at 30-Apr-2018 (note that airlines operating under a single brand are counted as one for the purposes of this analysis) and 497 that do not.

The chart below shows the 72 that have orders ranked by the number of orders as a percentage of their current fleet. These range from Wizz Air, with a ratio of 284%, to KLM, with just 4%. Narrowbodies dominate orders, accounting for 76% of the total in Europe.

Notably absent from the list (i.e. with no orders at all) are some fairly large airlines such as Alitalia, Austrian Airlines, Condor, Ukraine International Airlines and Thomas Cook Airlines.

European airlines with outstanding aircraft orders, ranked by number of orders as a percentage of current fleet at 30-Apr-2018

13 airlines have order numbers representing more than 75% of their current fleet

There are 13 airlines whose outstanding orders represent more than 75% of their current fleet in service (and eight with a ratio of 100% or more). The 13 are outlined below.

Wizz Air. With 273 aircraft on order and only 96 currently in service, Wizz Air's orders are 284% of its current fleet. This puts it at the top of the orders list, both in absolute numbers and as a percentage of aircraft in service. Its orders comprise 184 A321neos, 72 A320neos, 13 A321ceos and four A320ceos.

Its current average fleet age is just 4.7 years so the orders are mainly about growth, and Wizz Air expects to have a fleet of 127 aircraft in FY2020.

Primera Air Group. The Nordic low cost operator has only 10 narrowbody aircraft currently in service (seven with Riga-based Primera Air Nordic and three with the Copenhagen-based parent Primera Air). Its average fleet age is around 14 years.

Its 27 orders (20 737MAX-9s for delivery in 2019 and 2020 and seven A320neo family, including two A321-neoLRs for 2018 delivery) give it a ratio of orders to fleet in service of 270%, to replace and expand its fleet. It has followed Norwegian in launching low cost trans-Atlantic flights from bases outside its home region (UK and France) this summer.

See related report: Primera Air: fast growing Nordic leisure airline follows Norwegian's long haul LCC path

Red Wings. Moscow Domodedovo-based Red Wings operates 14 aircraft (eight A320 family and six Tupolev 204 narrowbodies) averaging 14.1 years old. Its 22 orders (16 Irkut MC-21s for delivery in 2021 and 2022 and six Bombardier CS300s for 2019 delivery) represent 157% of its fleet in service.

Norwegian Group. Its 220 orders - the second highest in Europe in absolute numbers - represent 147% of its 150 aircraft currently in service (with an average age of only 3.8 years). Its orders, all for new generation aircraft, comprise 104 737MAX-8s, 58 A320neos, 30 A321neoLRs and 12 787-9s.

Travel Service. The all-Boeing Czech operator has 37 MAX orders for delivery by 2021 and a current fleet of just 26 (including one in each of its subsidiaries in Poland and Hungary). It has already taken delivery of two MAX8s.

Its scheduled services are operated under the SmartWings LCC brand. Although its aircraft are less than 10 years old on average, its orders represent 142% of its current fleet, signalling strong growth plans.

See related report: Travel Service: purchase of majority stake in CSA Czech Airlines shows fast growing group's ambition

Pegasus Airlines. It has 85 orders, equivalent to 115% of its mixed Boeing and Airbus fleet of 74 narrowbodies, in spite of a current average fleet age of only 5.6 years. The deliveries (82 A320neo family and three remaining 737-800s) are due by 2024. The fleet is expected to grow to 110 aircraft in 2022.

S7 Airlines. Its 69 orders are 19 A320neo family and 50 unconfirmed for Sukhoi SSJs and represent 110% of its current fleet of 63 aircraft. S7 will be part of supervisory board overseeing the development of the Sukhoi SuperJet 75, for which it could become the launch customer.

The current fleet (with an average age of 11.3 years) comprises 48 A320 family aircraft (including four A320neos) and 15 Embraer regional jets. The airline has its main hub at Moscow Domodedovo and its headquarters at Novosibirsk in Siberia.

La Compagnie. The smallest operator in the list of European airlines that have orders representing more than 50% of their fleet, it has a fleet of two Boeing 757 aircraft (average age 21.2 years) and orders for two Airbus A321neos for 2019 delivery. The Paris Orly-New York JFK specialist (after moving its Paris base from CDG), which operates an all business class configuration, merged with the long haul low fare operator XL Airways France in 2017.

Germania. Its 25 aircraft Airbus A320neo orders, for delivery by 2022, almost match the 26 aircraft that it currently operates (17 A320 family and nine 737-700s). These orders will provide replacements for its current fleet, which has an average age of 14.1 years, and allow growth.

The demise of airberlin may help the privately owned and fast growing Berlin-based airline, whose main hub is at Duesseldorf, to emerge from the shadow of larger German competitors.

Volga-Dnepr Airlines. The Russian freight specialist, based at Ulyanovsk Vostochny Airport, has 16 (unconfirmed) Boeing 747-8F orders, almost matching its current fleet of 17 (12 Antonov and 5 Ilyushin aircraft).

It is the only airline in this list of those with orders representing more than 75% of the current fleet that has only widebody aircraft on order and one of only two named airlines with 747 orders.

See related report: Boeing's 747 aircraft fleet: the original jumbo, overtaken by the 777

PrivatAir. The wet lease specialist's six orders (five Bombardier CS100s and one Boeing 787-8) are one less than the fleet of seven aircraft operated by the group (including four narrowbodies with PrivatAir Germany).

Severstal Aircompany. This Russian regional airline, owned by a leading steel production company, operates six Bombardier regional jets and one Yakovlev regional jet in the domestic market. Its six orders, for the Sukhoi RRJ95, almost match its current seven-strong fleet.

Air Europa. Spain's second airline has 37 orders for delivery by 2022 (20 737MAX-8s, three 737-800s and 14 787-9s), equivalent to 79% of its current fleet of 47 aircraft (including six operated by Air Europa Express). With the fleet having a relatively low current average fleet age of 7.3 years, these orders signal its growth ambitions.

European airlines with outstanding aircraft order numbers of more than 75% of current fleet at 30-Apr-2018

|

Airline |

Aircraft in service |

Aircraft orders |

Orders as % of current fleet |

|---|---|---|---|

|

96 |

273 |

284% |

|

|

Primera Air Group |

10 |

27 |

270% |

|

14 |

22 |

157% |

|

|

150 |

220 |

147% |

|

|

26 |

37 |

142% |

|

|

74 |

85 |

115% |

|

|

63 |

69 |

110% |

|

|

2 |

2 |

100% |

|

|

26 |

25 |

96% |

|

|

17 |

16 |

94% |

|

|

PrivatAir Group |

7 |

6 |

86% |

|

7 |

6 |

86% |

|

|

Air Europa Group |

47 |

37 |

79% |

In addition to the airlines listed above, there are some airlines that have orders but no existing fleet (and therefore the number of orders is an infinite percentage of their current fleet).

These include SkyUp, a proposed new Ukrainian airline (five 737MAX orders); Borajet, a Turkish airline that suspended operations in 2017, but plans to resume services once the Istanbul New Airport opens (five Embraer regional jet orders); and Odyssey Airlines, a UK start-up that plans New York services from London City (10 Bombardier CS100s on order).

Orders as a percentage of current aircraft in service give a guide to the future

The number of orders that an airline has outstanding as a percentage of its current fleet size does not perfectly correlate with its future growth ambitions. An airline may have recently completed a large order or, alternatively, it may be about to place one. Nevertheless, this ratio gives a fairly useful indication of an airline's ambition by scaling orders with respect to existing fleet size.

It is highly indicative of Wizz Air's ambition that its orders are at the top of both the absolute order numbers and the ranking of orders as a percentage of existing fleet. Norwegian is also highly visible by both measures.

However, smaller airlines such as Primera Air and Red Wings would not be very noticeable by their absolute order numbers, but demand attention when their orders are shown as a percentage of current aircraft in service.

This list guides airline industry observers and competitors to which European airlines might be worth watching into the future.

Source: CAPA Fleet Database.

Source: CAPA Fleet Database.