Today, more than ever lowering unit costs is a key strategic initiative for airlines. Recent fuel price escalation in addition to maintenance and labor cost pressures are challenges airlines need to focus on to protect margins. On the other hand, airline fares continue showing a downward trend especially in coach cabin. This has been accelerated by ULCC/LCC including Long Haul Low Cost (LHLC) carrier expansion. Therefore, the pressure to optimize revenues and reduce unit costs are strategic initiatives discussed every week at board meetings to maintain a profitable operation.

In order to maximize profits, many global airlines use a combination of multiple fare structures, multichannel inventory distribution, and multi cabin class products among others. For example, a lower yield leisure market such as Gatwick commands a difference revenue optimization strategy than a stronger primary hub. For example, Emirates Airlines reconfigured an Airbus A-380 in a high-density seat capacity with no first-class cabin and only two class products (business and economy) intended to operate at Gatwick in order improve profitability. Due to a number of cost pressures described above, a number of airlines are swapping aircraft layouts to suit market demand being cabin densification a key focus. This can be observed especially in highly competitive markets such as Gatwick. In a push to fight lower airfares and boost competitiveness, many airlines are spending money to increase seat capacity. On the other hand, Heathrow first-class/premium/leisure traffic mix with more profitable potential commands a different cabin layout and pricing strategy.

While many premium airlines such as Singapore Airlines, Cathay Pacific and a number of Middle East carriers continue assessing how to best match supply and demand, many others have neglected installing first class cabins. One example is Qantas, which on newer aircraft has decided to install more business class and premium economy seats. In fact, we can observe a clear trend employed by airlines today: Premium Economy and economy class revenue will be soon expanded primarily due to a higher seating density in those cabins.

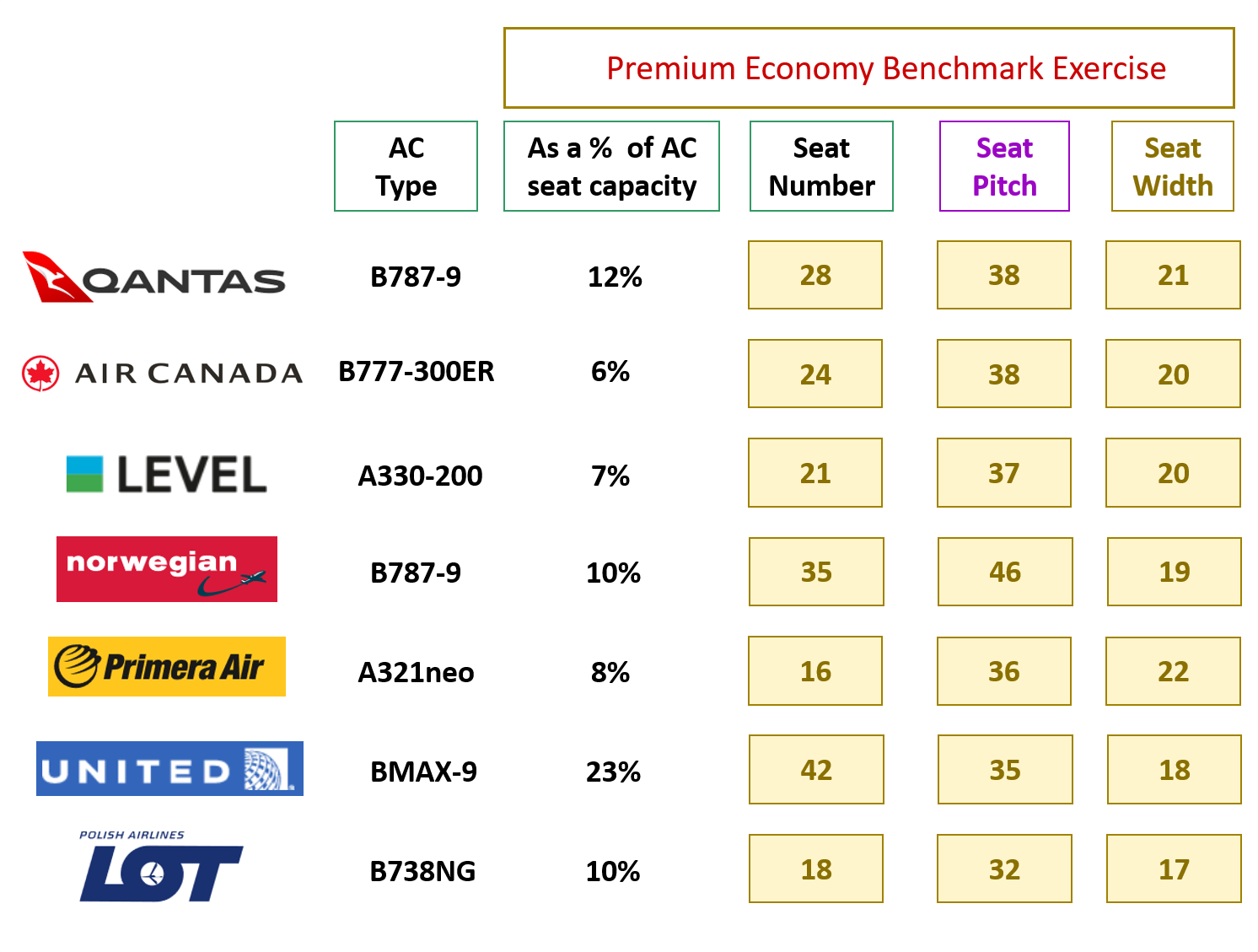

A Premium Economy cabin product fills a gap between business class and standard coach cabin. It is found mostly on international long-haul routes, it typically offers 6 to 10 inches of extra legroom when compared with standard economy class and represent on average 9% of total aircraft seat capacity (see chart). Depending on the time of booking, a premium economy class ticket could be twice as much as a standard economy. Moreover, on average it can be up to 70% less than a business class ticket based on an airline benchmarking exercise conducted when considering a number of factors including routing, competition, time/day of booking among others.

As recently observed, not only passenger yields in premium-class cabin including Premium Economy product have trended upwards for a year now as its demand and fares are typically less price sensitive when compared to coach class but also airlines continue observing an increased demand for premium economy and business class products globally as most corporate travel policies allow for business and/or premium economy class booking especially for long-haul flights. As airlines could potentially transfer higher unit costs such as fuel price escalation onto premium cabin, a number of Full Service (FSC) and hybrid carriers are evaluating or will probably introduce soon a Premium Economy product becoming this one a win-win strategy for airlines. Even more as unit cost are expected to continue rising, it is clear why airlines are considering or operate today a premium cabin product – As it will end up assisting

airlines to derive a revenue premium, make the most amount of possible revenue, increase margins and optimize profitability while fighting head-to-head budget carrier expansion.

But not only airlines are observing this trend, even aircraft OEMs have recognized the rise of premium economy cabin trend among airlines and are promoting different and flexible premium economy and business class cabin concepts. Especially, as global airlines are demanding more flexibility than ever, aircraft manufacturers are planning to introduce enhanced cabin options in order to target key airline operations that may include particular airline routes with unique passenger mix, seasonality conditions, variable length of trips, market dynamics while offering greater flexibility when it comes to revenue optimization.

But let’s review a number of airline premium cabin examples in wide body aircraft: FSC business model. First, Qantas’ newest aircraft, its Boeing 787-9 Dreamliner offers 236 seats. Interior features 42 lie-flat business class seats in a 1-2-1 layout, 28 Premium Economy seats in a 2-3-2 configuration, and 166 standard economy seats in a 3-3-3 layout. In addition, recently Qantas announced its A-380 cabin upgrade which shows its premium economy cabin growing 71% to 60 seats.

Second, Air Canada Boeing 777-300ER is outfitted with 400 seats. The interior features 40 business class seats in a 1-2-1 configuration, Premium Economy offers 24 seats in a 2-4-2 configuration and 336 in the Economy cabin in a 3-4-3 layout.

LHLC business model. First, Primera Air – Airbus A321neo: Offers 198 seats in a two-cabin configuration.

Sixteen recliner-style Premium Economy class seats followed by four rows of economy “seat front section” which might qualify for a higher fee than a standard economy seat due to its proximity to the front of the cabin and expected extra legroom. Total of 182 standard seats in economy class are offered in a 3 by 3 layout. Second, LEVEL A330-200 offers two cabin products. In Premium Economy, there are 21 seats in a 2-3-2 configuration and economy cabin featuring 293 seats in a 2-4-2 layout. Third, Norwegian Air Shuttle, Boeing 787-9 Dreamliner is outfitted with 344 seats. Interior features a Premium Economy cabin with 35 seats in a in a 2-3-2 configuration and 309 and economy cabin in a 3-3-3 layout.

In terms of pushing long haul Premium Economy cabin sales forward, there are few innovative approaches airlines are capitalizing on. A number of airlines are testing 360 degrees virtual reality videos to ticketed long haul passengers waiting at boarding gates. That is an interesting last-minute pushed strategy. However, many airlines concur that other strategies aimed at revenue conversion 7 days to 4 hours before departure are still under development and a number of questions remain related to when, where and by which channel an airline should offer a Premium Economy cabin to its potential coach customers. This is something many airline are still fine tuning as they are specific moments in a passenger journey where customers might favorably respond to a Premium Economy cabin upsell. Not doing it or done incorrectly through a not efficient sales channel may reduce revenue conversion resulting in an important missed revenue opportunity.

Finally, concerning a narrow body fleet and related to if a Premium Economy cabin makes financial sense, it is not as easy one as the size/width of the cabin of a narrow body has much less cabin room available to play with. Simply put, an airline can fit more premium cabin seats across in a wide body aircraft than on a narrow body such as an A321neo or Boeing MAX-9. Therefore, it is paramount to run a number of analysis and scenarios related to how many premium economy seats can be fit in vs. how many seats an airline will lose for example in coach vis-à-vis a targeted revenue per square footage. As per previous example given, always look for one key goal in this exercise – That is to find the best configuration that make the most amount of revenue for the airline based on market dynamics, competitive environment among other factors. At least in a number of high yield premium routes and potentially international long- haul hub connector to domestic routes, flying a narrow body aircraft in Premium Economy configuration seems to be making sense for a few airlines. That is the case of United Airlines Boeing MAX 9 and LOT Polish B738NG which believe there is a solid case for a Premium Economy cabin as both currently operate one.

René Armas Maes: International Consultant and manages a number of global consulting projects with key focus on revenue optimization, cost reduction, business restructuring, strategic planning, risk mitigation and process streamlining. He is an IATA instructor and a regular columnist for AerolatinNews.

In addition, he is a regular contributor for a number of air transportation magazines in Canada, USA, Europe and Latin America. He can be reached through his LinkedIn page.